In Earnin, you can withdraw small amounts of your income before payday. Instead of charging fees and interest, it directs you to spend the amount before payday. Once the paycheck amount gets transferred, the app will automatically deduct the sanctioned amount. If you also need an emergency fund and somehow heard about Earnin. Then you should go through a complete Earnin App Review from this article before doing anything that may hit your pocket later. Let’s take a look.

Earnin App Review

On many occasions, you may need an emergency fund to settle your issues. In that case, one may not go through a rigid documentation process with the bank or other money lenders. Contrary, you would prefer knowing the fastest way possible. Earnin Reviews confirm that it is not undoubtedly a typical paycheck advance/loan. However, you should refund the amount on the paycheck day with a voluntary tip amount in the range of $0 to $14. Though, you have an option for your finances. However, you must omit to rely on it to cover all your cash needs.

Moreover, you should understand that it is a mediator and varies its services from person to person. The most undeniable fact is that you have to pay the money back in any case. And when you make it a habit, it can ruin your financial goals. There are another options to consider, i.e., PayDaySay, Dave App to arrange emergency funds in your account.

Pros and Cons of the Earnin App

Like other finance apps, this app also has some merits and demerits:

Pros

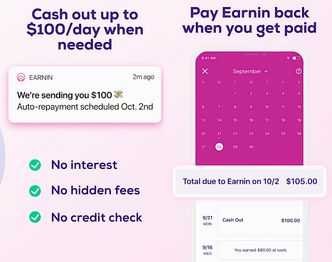

- No mandatory fees

- No credit check

- Same-day fast funding

- Interest-free

- Easy-to-use app

- Low balance watch

Cons

- Track your work hours with a bank account link

- No customer service

- No Lower limit reason

- Direct deposit eligibility

- Higher tip percentage

Is Earnin Legit?: Earnin App Review

Yes, the app is legal, as per the statement revealed by the app developers and service providers. It is safe if you use the advance paycheck amount in limit and don’t collect the heavy pendency against you. Furthermore, the personal details and information provided by you are encrypted. A credit score report is also unnecessary because it will give them a complete record of your loan or debt history. Apart from that! SSN or social security number is essential when one registers for the application. Other than that, you are not bound to reveal your particulars.

Is Earnin Safe?

Following Earnin Reviews, we can say it is both. Safe and Unsafe. For small emergency expenses, paying the bill, you are earning, and there is no overdraft fee for you. It is safe. Contrary! It is unsafe when you are in the habit of routine usage and paying your hard-earned money on extra charges or optional tips.

How Does Earnin App Work?

To access the app and its features, you must know how it works for borrowers. Follow the simple guide to download and install it on your mobile phone:

- Earnin App is available on Android and IOS. Download and install it following the instructions given on the work.

- Create the account with valid details and let the service provider verify your particulars within two-three days.

- You need to enter your employment details to give access to tracking your working hours and deciding the emergency fund for you.

- While you request the amount, you have to activate the direct deposit and allow for the tip depending on the fund sum from the paycheck.

- Wait for the approval, and get the amount transferred into the bank account within 1-2 business days.

How to Cash Out on Earnin?

Once you download the app and complete the verification of the personal details, you can cash out $100/day to $750/pay period. However, you need to put your payment service on direct deposit with a paycheck.

What Happens If You Don’t Pay Earnin Back?

Firstly, you should not ignore paying back to Earnin or any other money lender because it will amplify the issue instead of settlement. You may ask them for negotiation and consolidation giving genuine responses. If you don’t pay Earnin back, the account will be blocked with all the accrued payments from your side. However, the outstanding amount will be pending until it gets settled from both sides.

How to Delete Earnin Account?

You cannot delete the Earnin account if you have an outstanding amount. Clear statement holders can follow the process to delete their Earnin Account.

- Open “Settings” by clicking on the triple bar from the bottom right of the application.

- Go to your profile and click “Close My Account” to follow the instructions and delete the account.

Read more: CatMouse APK Download: Enjoy Cinema Anywhere [Download & Installation Steps]

The Bottom Line

We have covered almost all sections for the Earnin app review. It is among the most demanding cash advance apps that facilitate you to pay the bill on time and repay it on payday with a direct deposit system. It is safe and legit to use, provided you take its terms and policies lightly for the repayment.

Have a look at other loan apps also:

Frequently Asked Questions

Can I delete the Earnin account without payment?

No, you can’t delete your account without complete repayment for the transfers made by Earnin to you.

Does Earnin require an SSN?

Yes, to register on the app, you require an SSN.