Many times we find ourselves helpless to manage our finances. And that can be for various reasons. Either you haven’t been stuck to your budget as before, or some emergency bills have broken your stable monetary schedule. If that’s the case with you, you must be thinking of your friends and family members to help you in need. But what if that is also not possible? Maybe they can’t do that. Whatever cause you anticipated, there is still one way (PayDaySay Reviews) you can go to keep your finances on track till your next payday. PayDaySay Legit is one corresponding solution where you fulfill all your monetary requirements following easy repayment policies. Let’s know more about it.

What is PayDaySay?

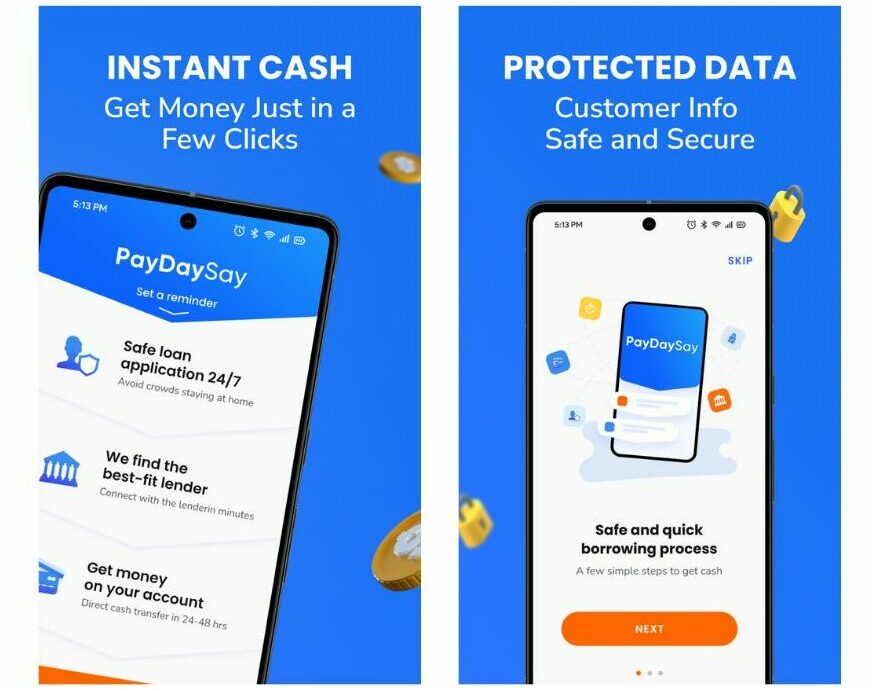

According to PayDaySay Reviews from different platforms and sources, it was found that you can count on this platform to manage your short and sudden financial emergencies. You must have a smartphone with enough space to download the PayDaySay app and use it frequently. Moreover, you require authentic information to sign up on the platform and then log in to request the loan and receive the money approved by the service provider. Furthermore, you must fulfill the criteria set by PayDaySay for money transfers and seeking negotiable repayment terms.

Features of PayDaySay

Multiple features lead you to rely on PayDaySay to arrange emergency funds in your bank account. Let’s see them in detail:

- The app is safe and secure for various details provided or revealed by the borrower. If you have shared the information on the app, it will be there only, and no third party can access it for any reason.

- Paydaysay makes sure different loans type for binding its customers for its services. For your benefit- it deals in emergency/installment/business and debt consolidation loans.

- Furthermore, whatever the interest rate is! It would get disclosed before you officially accept the money transfer. There are no mid-way changes. However, the Interest rate may be higher depending on your debt history and your impression before them.

- There is no credit check. So if you are new to this experience, you can sign up on the platform without any hurdles.

Pros

- Loan amounts from $100 to $5000

- No early or pre-payment penalty

- Complete online procedure

- Paperless procedure

- Enough loan types

- No part-payment fee

- Maintains credit score

- Short-term for repayment

Cons

- Higher Interest rates

- Need bank to track the income and expenditure

- Very short-term loan

- Debt trap if not repaid on time

How to Qualify for PayDaySay?

To make yourself qualify for the PayDaySay loan types, you must fulfill these criteria:

- You should be 18 years+ to register on the platform and request the loan.

- A Social Security Number is necessary to verify your identity and residential address.

- Furthermore, you should have an active bank account number.

- The borrower must have an Income document to guarantee timely repayment.

- In the end, you should have submitted some additional details.

How does PayDaySay Work?

- You can access the app via the Company website or Mobile device.

- After downloading and installing, fill out the details that occurred on the screen to lead the following process.

- The details include full name, residential address, contact number, credit type information, and more.

- Let the service company complete all the research on your shared information.

- Once you get the response as a report, read every detail thoroughly.

- You must highlight the loan amount qualification, interest rates, terms, and repayment conditions.

- In the end, finalize the loan type and share the bank account number to receive the money within the standard time set by the company.

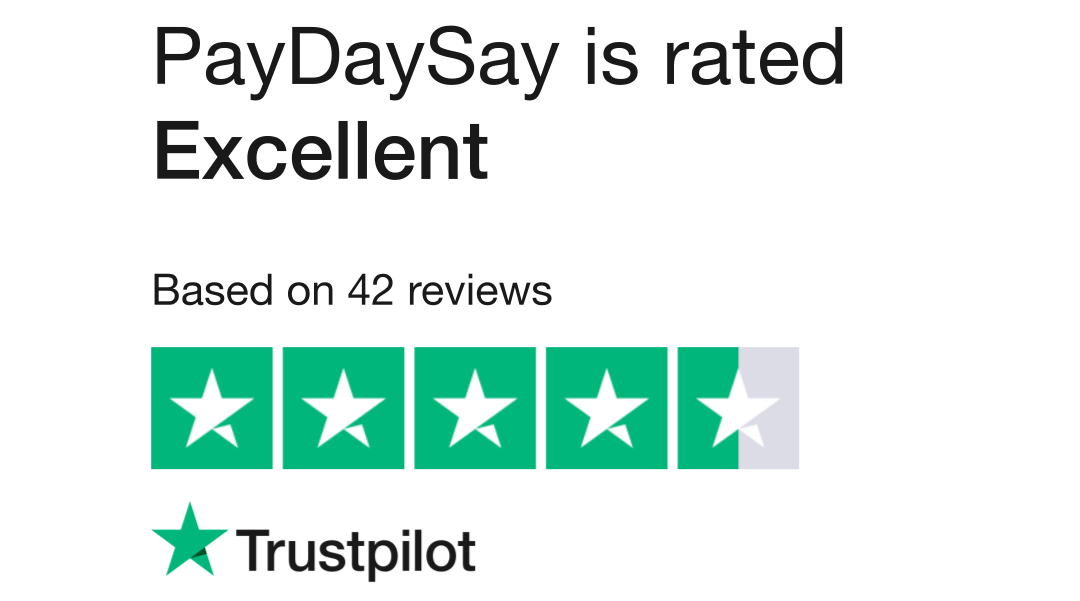

Is PayDaySay Legit?

It partners with financially accredited organizations to give you instant service 24/7. All your data shared by the lender will be kept for authorized services only. There is no reason for its sharing with unauthentic sources, platforms, and money lenders. It scored 4.7 out of 5 from the genuine medium of 42 reviews from the users.

PayDaySay Customer Service

Customers have got a satisfactory response from the company. There is no space to leave even a single answer to your query. You only have to visit the website or the app for the customer service section to write to them about your issues. Moreover, you can copy the customer service email address and write them from your registered mail id. In 24/7 time, you can use the app according to your requirement and put the query to get a handful of responses.

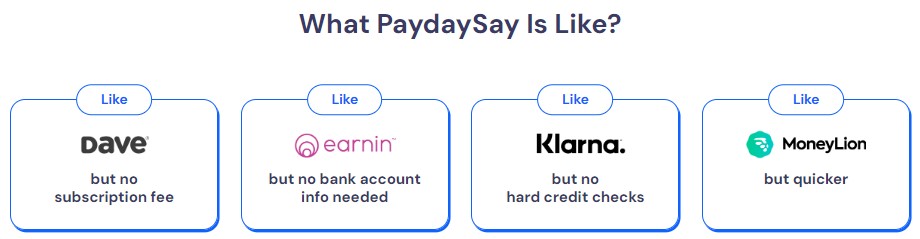

Additional Information About PayDaySay

You can compare PayDaySay legit to other types of online lenders to produce the trustworthiness and reliability of the PayDaySay. Recommended names in the market are Dave, Earnin, MoneyLion, and Brigit. Moreover, some terms like qualified loan amount, loan transfer time, repayment time, annual rate, and fee are necessary to compare before sharing the bank account number to finalize the loan deal.

Read also: Redefine Personal Entertainment with Pikashow APK – Download in 2025

Conclusion

That’s all about PayDaySay reviews. For several reasons, you might go through a time when you may not be confident about the best money lender for yourself, especially when you need money instantly. Moreover, you don’t have any experience dealing with such types of creditors as you haven’t faced a financial crisis before. Whatever the cause is, you can switch to any PayDaySay legit loan type to know your qualification for the desired amount. The article has covered all the major points in this regard. You may go through any part and apply for the loan instantly to get the necessary funds in your account.

Have a look at other loan apps also:

Frequently Asked Questions

What are the Terms for Loan Qualification on PayDaySay?

There are 3-major points where you have to qualify to get the PayDaySay loan amount in the desired account.

- You should be 18+ years of age.

- Should have residential address proof of the USA.

- Active bank account.

Does PayDaySay Affect the Credit Score of the Borrower?

Yes, like all other payday loan providers, PayDaySay also informs your debt repayment performance of the credit bureaus. If you haven’t repaid the loan on time or become a defaulter, your credit score will drop.